Understanding your Payslip

Your Payslip explained.

Dear Colleague,

Thank you for clicking on the link to receive a more complete explanation of the pay adjustment on this month’s pay statement. Please be assured there is nothing to worry about with your pay as hopefully the below will show. It’s a bit complicated so bear with us!

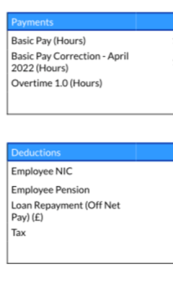

You will have seen 2 new elements on the pay statement that you would not have been expecting, they are as follows:

• Basic Pay Correction – April 2022 (Hours)

• Loan Repayment (Off Net Pay) (£)

It will look like this on your Pay statement:

You will of course be aware that you did not apply for, or indeed receive, a Loan in the previous month and will be rightly wondering what this is.

You will probably be aware that last month a mistake was made with the payroll for about half of the colleagues that work in the All Saints, Lavender Court, and St George’s Court Independent Living Schemes where the hourly increase for April was not applied, and the previous pay rate was used.

This was an error with the payroll software that is used to make payroll payments, it is operated by a third-party company, Care is Central has no control over this software and was not in a position to prevent the errors.

As soon as we were made aware of the error we took steps to correct it and decided to make an interim payment to all affected staff on the following Friday after payday.

As a gesture of goodwill, we took the decision to not only pay the money owed but to also backdate the £1 an hour increase for the whole of the pay period, this meant your £11.03 pay rate was used to calculate your pay from the 21st March to 20th April, instead of from the 1st April to the 20th April. This equates to an extra week and a half at the enhanced pay rate. So as not to disadvantage those staff that had received the correct payments we also made an interim payment to those team members for the increased pay rate for the period between 21st March and 1st April.

Unfortunately, HMRC can only calculate and deduct tax on a monthly basis, and they cannot make sense of an interim payment like the one we made. In order for us to remain compliant, we have to officially call this payment a loan when we make the payment and then again note it as a loan on this month’s payslip and take it back. We then pay you the money again but this time on a monthly pay run that the HMRC can tax appropriately. On this month’s pay statement you both get paid the money on the Basic Pay Correction – April 2022 (Hours) line and have it removed on the Loan Repayment (Off Net Pay) (£) line. Canceling itself out!

In short, it is paid twice and recovered once meaning you now have the right amount of money and have also paid all appropriate taxes. Nobody that is subject to this process has in any way been disadvantaged or lost money.

You will probably notice that the amounts for Basic Pay Correction – April 2022 (Hours) and Loan Repayment (Off Net Pay) (£) do not match, and you will be wondering why this is the case. Put simply, the Loan Repayment figure is the same amount as the Basic Pay Correction but with the tax taken off it. This allows for the correct amount of money and tax (taken off by HMRC) to match up across the two payment runs.

Hopefully, this will have put your mind at rest. It’s a complicated process and whilst your payslip may look odd, in essence it has allowed us to pay all staff members correctly, with the additional pay from last month, without any effect on the tax you pay. However, if you would like a fuller description and an example of how the payment is broken down, please see below.

Further Explanation:

As I stated above, there is no means for recovering tax in an interim payment. So if we owed a staff member £100 and we paid them £100 when the Basic Pay Correction – April 2022 (Hours) was made in the following pay run it would be taxed and the staff member would receive less pay than they were expecting.

We, therefore, avoid this by paying people 77% of the amount owed which equates to the amount most people would receive after their pay was taxed.

To give you an example:

- John Smith was paid 100 Hours at £10.00 an hour, this equates to £1,000 Gross pay, (before tax)

- John paid £40 in tax and took home £960 after tax.

- He should have been paid 100 Hours at £11.00 an hour, this equates to £1,100 Gross pay, (before tax)

- John would have paid £63 in tax and took home £1,047 after tax.

- The company realising their mistake paid John an interim or corrective payment of £77, which took his pay for that month from £960 to the correct £1,047. To comply with the law and HMRC rules they had to call this additional payment a “loan payment”.

- The next month they recovered the “Loan Payment” of £77, which closed the “loan” off.

- At that point, the company still owes John £100. So they make a Basic Pay Correction – April 2022 (Hours) of £100 to John’s pay.

- The Tax Man, HMRC, then deducts £23 in tax from that £100 leaving John with £77. The Loan Repayment (Off Net Pay) of £77 and the Basic Pay Correction – April 2022 (Hours) of £77 cancel each other out.

John has now been paid the correct amount of money and he is also up-to-date with his tax liability.

I know this feels like a long-winded process to follow but it is the only way of ensuring that staff pay is corrected and the HMRC have all the payments they require. If you do have any questions, then we are holding a webinar for anyone who wishes to attend at 10am Friday 27th May by clicking on this link.